How Much Money To Buy An Apartment Complex

Many experts recommend that you hold up to 20 of your investment assets in real estate.

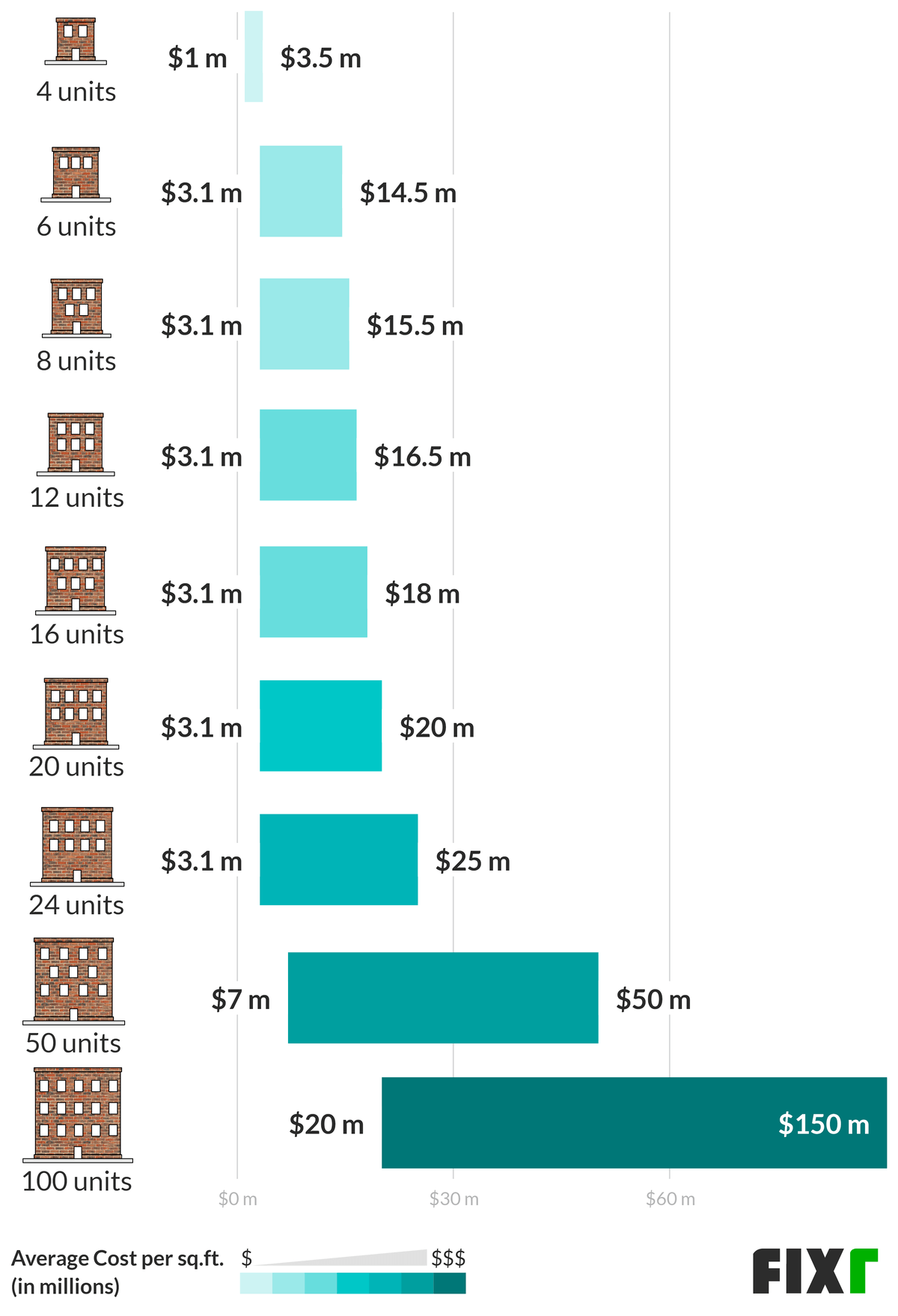

How much money to buy an apartment complex. Most lenders offer apartment loans from 1 million or 2 million up to many millions. We would pay for the first 100 and the tenant would be responsible for the remaining portion. Apartment Complex Financing.

LTVs top out at 70 or 75 percent which means the borrower needs a 25 or 30 percent down payment to buy or that much equity to refinance. Limit your personal liability as much as possible negotiate the loan documents. But all that aside I can tell you without a doubt that being able to buy an apartment building in this depressed market using 35 or 5 down with a fixed 30 year mortgage is an.

A lower ltv usually gets a lower rate. This is where having an experienced agent helps. Its no good to buy what you think is a cashflowing asset and then find out that it sucks money out of your pocket.

Of course this requires the most upfront capital and it can be the most intimidating of the methods listed here. If you improve the reputation of an apartment complex your vacancy rate should decrease accordingly. Youll typically need 30 percent down.

This single cost-saving step saved us over 6000 per year. Leverage - If you borrow a million dollars from the bank 4 and use it to buy an apartment complex with an 8 cap rate return on investment - you can profit off the difference. If you manage the building yourself you can reduce that expense.

And approval will be based more on whether financial projections show the property can support the loan payments than on your credit history. Management fees vary greatly but typically fall in a range between 3 percent and 7 percent of the rent collected. Here are six ways to invest in apartment buildings.

/multi-family-housing-construction-1163226282-0bc5b7ac983d4a3ea47070dacf640eb6.jpg)

:max_bytes(150000):strip_icc()/GettyImages-942487282-ae2da73b74aa4e868af3a6beac662e52.jpg)